The 3 Housing Market Questions Coming Up at Every Gathering This Season

Whether it’s at a family gathering, your company party, or catching up with friends over the holidays, the housing market always finds its way into the conversation.

Here are the top three questions on a lot of people’s minds this season, and straightforward answers to help you feel more confident about the market.

1. “Will I even be able to find a home if I want to move?”

Yes, more than you could a year or two ago.

The number of homes for sale has been rising over the past few years. According to data from Realtor.com, there have been more than one million homes on the market for six straight months, something that hasn’t happened since 2019 (see graph below):

- Buyers have more options.

- Sellers have more places they can move to next.

Many homeowners who held off are realizing the shelves aren’t bare anymore. So, if you hit pause on your home search last year because nothing fit your needs, it may be worth another look. With more homes on the market now, you’re not competing for the same handful of listings like you were a couple of years ago.

And because there’s a bit more to choose from, homes aren’t disappearing the minute they hit the market. That gives buyers more space to breathe, more options to compare, and a little more time to make a confident decision.

2. “Will I ever be able to afford a house?”

Affordability is starting to improve. Finally.

It’s been a tough few years for buyers. But this year brought some much-needed good news:

- Mortgage rates have been easing.

- Home price growth has been moderating.

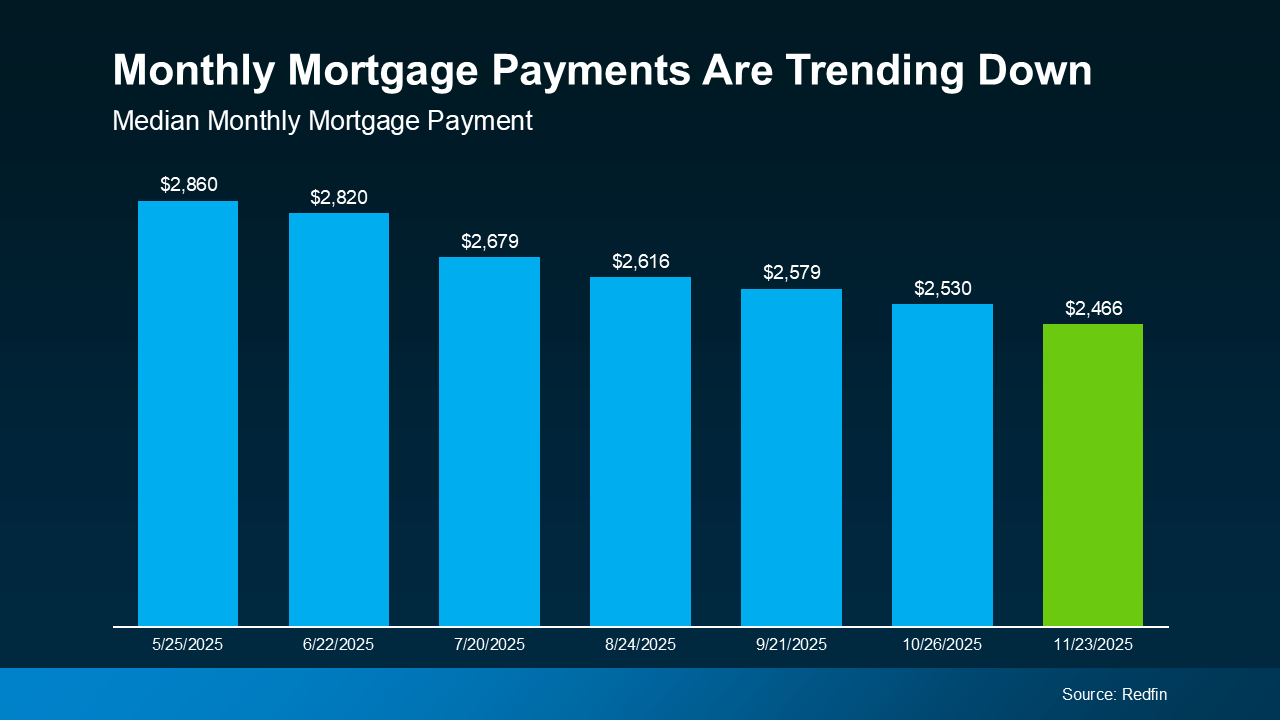

That adds up to a monthly mortgage payment that’s hundreds of dollars lower than it would have been just a few months ago (see graph below):

Buying still isn’t easy, but the numbers are starting to improve. For a lot of people, that means buying a home is becoming a more realistic goal again.

Buying still isn’t easy, but the numbers are starting to improve. For a lot of people, that means buying a home is becoming a more realistic goal again.

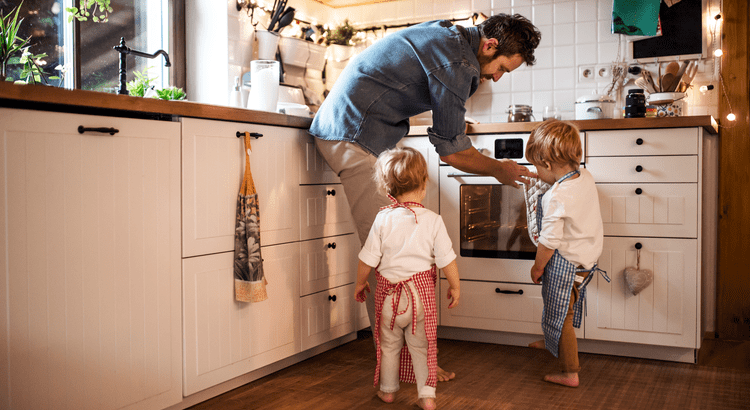

3. “Should I wait for prices to come down?”

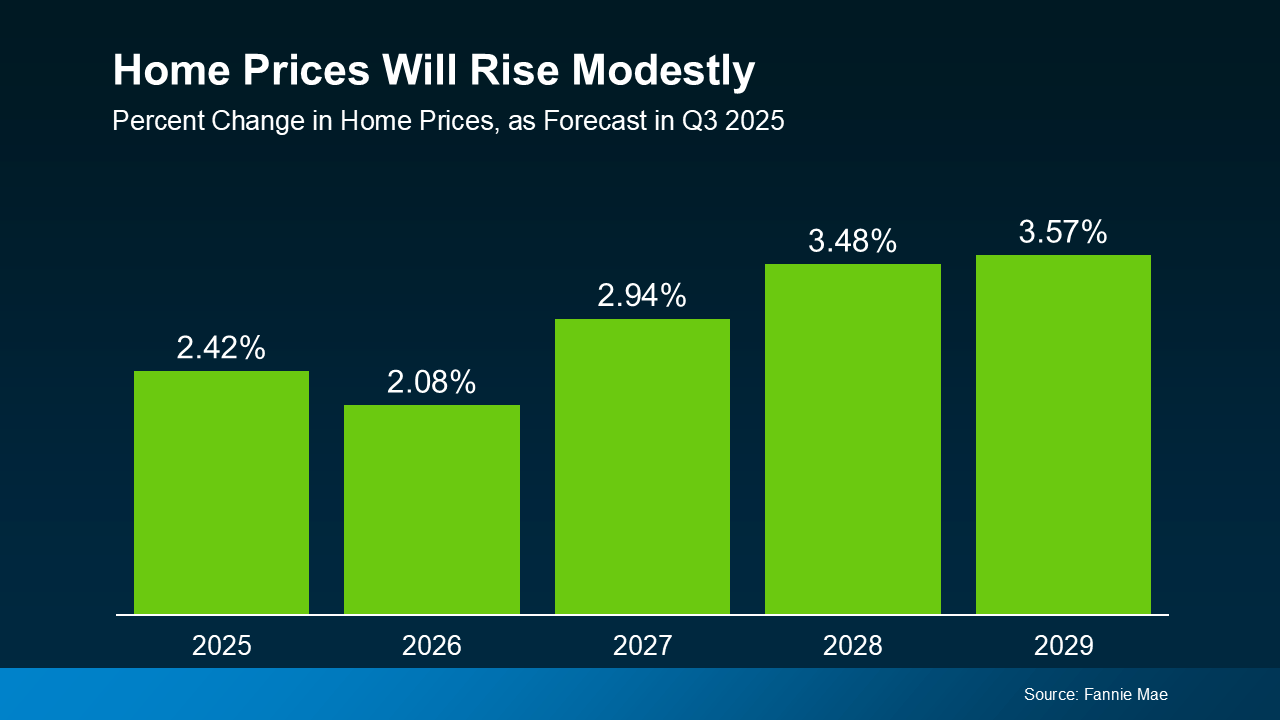

A lot of people worry that the housing market is about to crash, but the data doesn’t point in that direction. Yes, the number of homes for sale has been rising, but it’s still nowhere near the level needed for prices to fall significantly on a national scale. On top of that, homeowners today have a lot of equity and are in a much stronger financial position than they were back in 2008.

Of course, every local market is a little different. Some areas are still seeing prices climb, while others that saw huge spikes a few years ago are leveling off or seeing small corrections. But overall, the national picture is clear: experts surveyed by Fannie Mae project home prices will keep rising, just at a slower, more normal pace (see graph below):

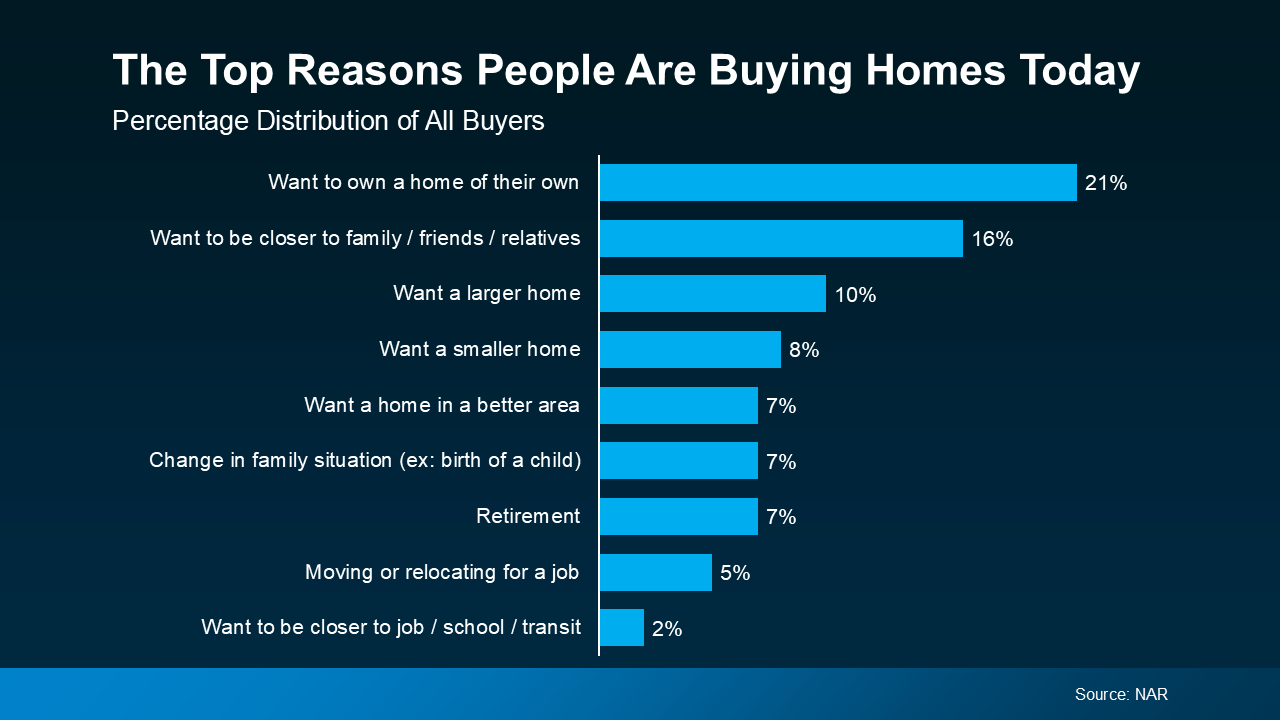

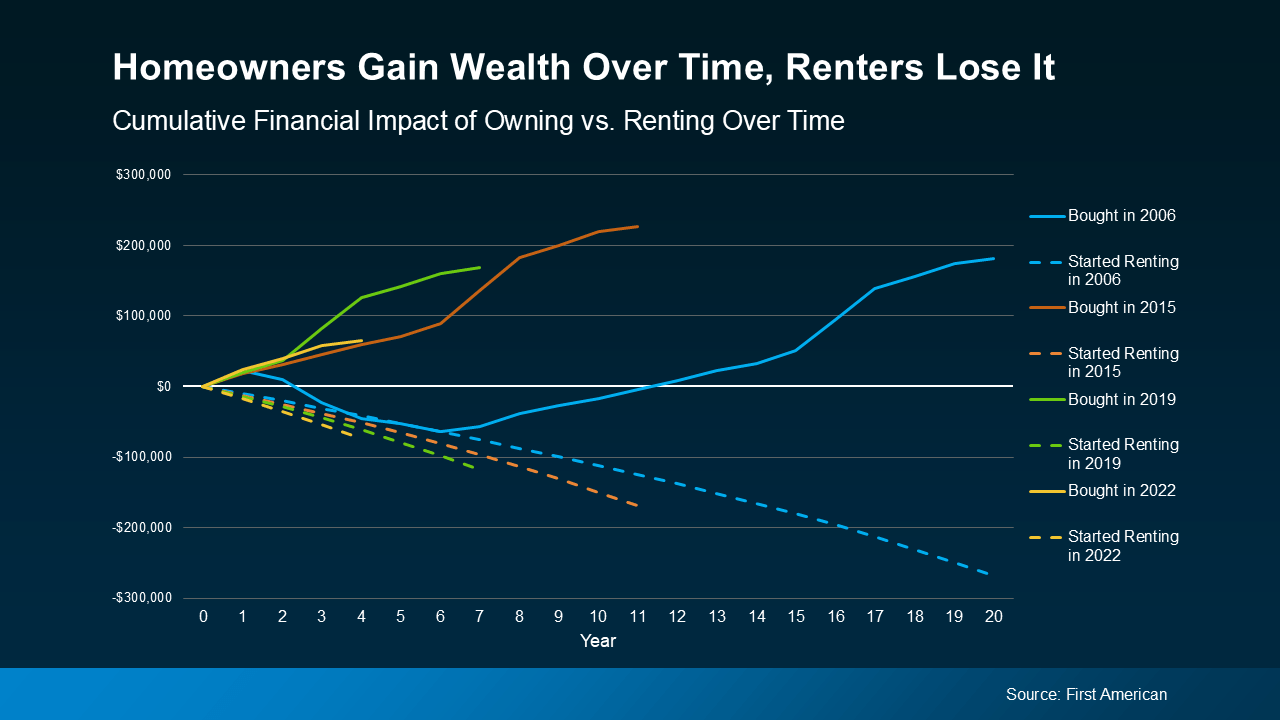

That’s why waiting for a major price drop to get a deal isn’t a very strategic plan. History shows the same thing over and over: people who spend time in the market tend to build the most long-term wealth, not the people who try to time the market perfectly.

That’s why waiting for a major price drop to get a deal isn’t a very strategic plan. History shows the same thing over and over: people who spend time in the market tend to build the most long-term wealth, not the people who try to time the market perfectly.

Bottom Line

Talk about the housing market can feel loud and confusing, especially when you’re hearing so many different takes. A trusted local agent can help you make sense of the data and understand your options. If you’re thinking about buying or selling, reach out to a local professional.

Zillow sums it up best:

Zillow sums it up best: