Experts Project Home Prices Will Increase in 2024

Even though home prices are going up nationally, some people are still worried they might come down. In fact, a recent survey from Fannie Mae found that 24% of people think home prices will actually decline over the next 12 months. That means almost one out of every four people are dealing with that fear, and you might be, too.

To help ease that concern, here’s what experts forecast will happen with prices this year.

Experts Project a Modest Increase

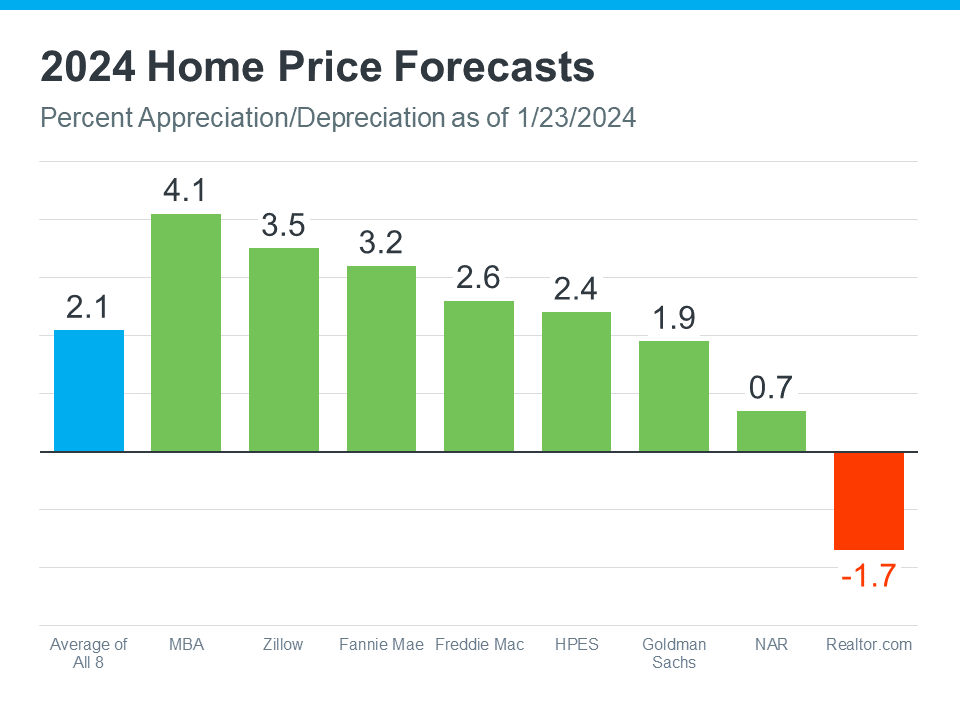

Check out the latest home price forecasts from eight different sources (see graph below):

The blue bar on the left means, on average, experts think home prices will go up over 2% by the end of this year – not down.

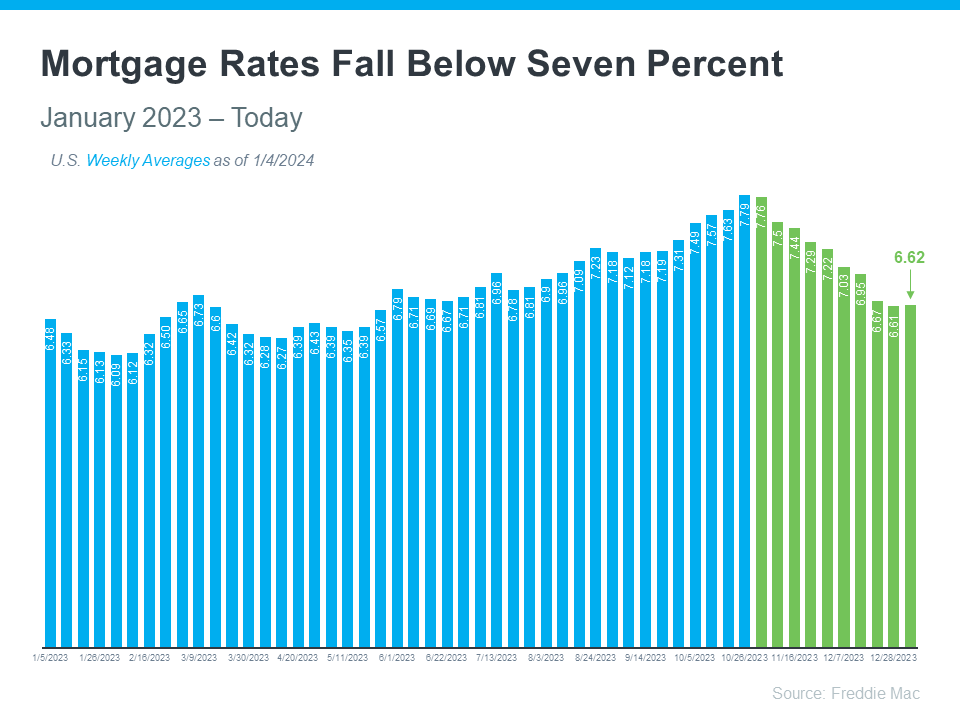

Prices aren’t likely to depreciate in 2024 because inventory is still tight and lower mortgage rates are leading to strong buyer demand. Those two factors will keep pushing prices up as the year goes on. As Selma Hepp, Chief Economist at CoreLogic, explains:

“With mortgage rates dropping, demand for homes in early 2024 is likely to be strong and will again put pressure on prices, similar to trends observed in early 2023 . . . Most markets will continue to reach new home price highs over the course of 2024.”

What Does This Mean for You?

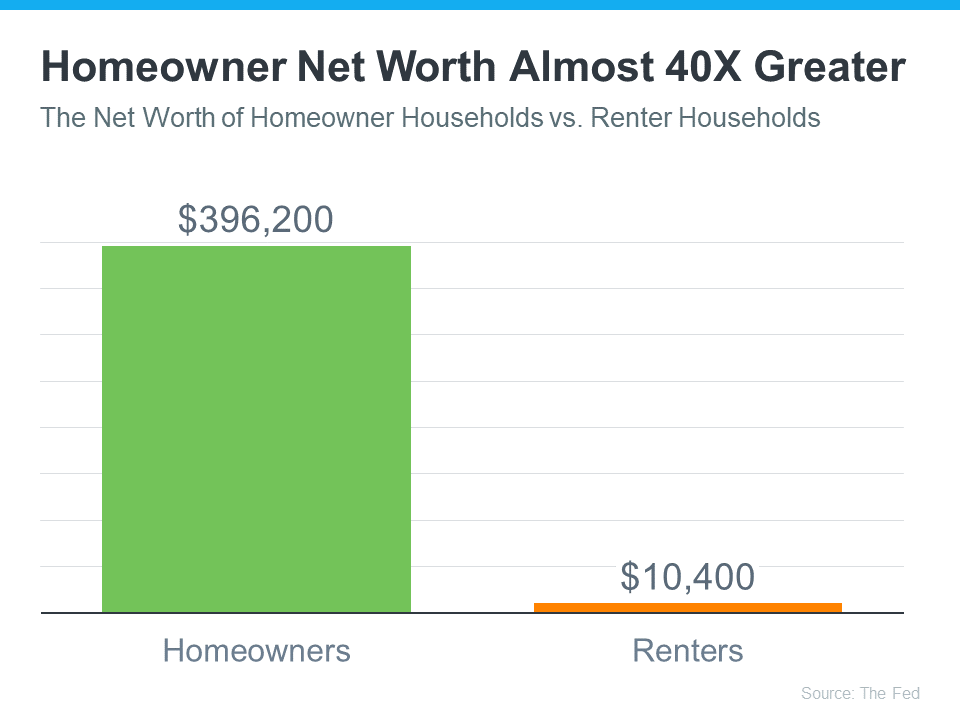

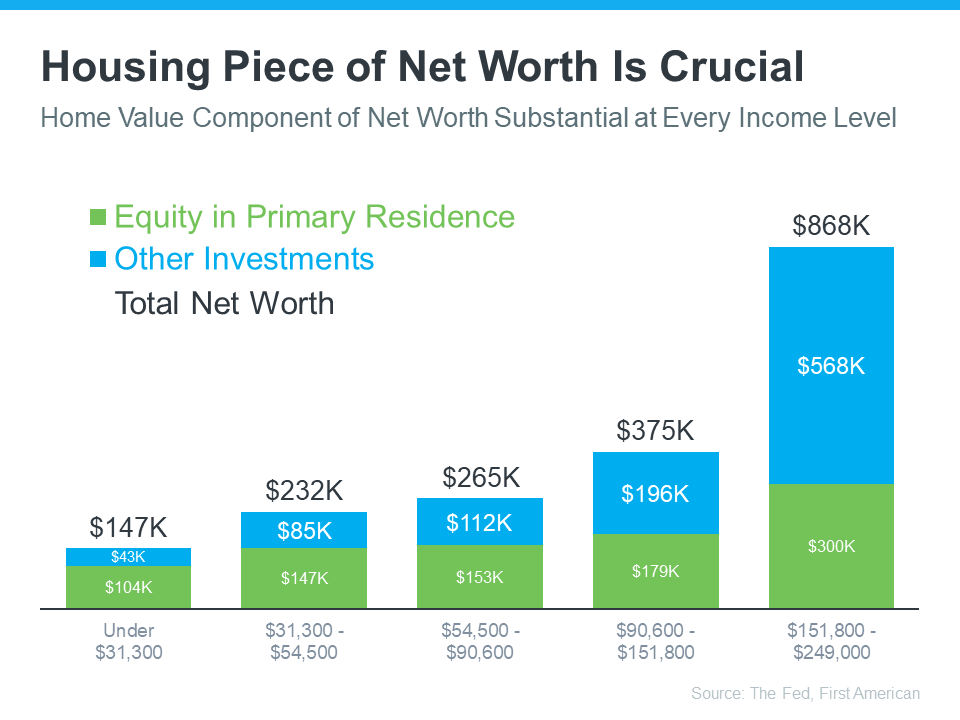

Experts are saying home prices will go up this year, and that’s good news if you’re thinking about buying a home. When you become a homeowner, you want the value of your house to go up. That appreciation is what builds equity and makes homeownership such a good investment over time.

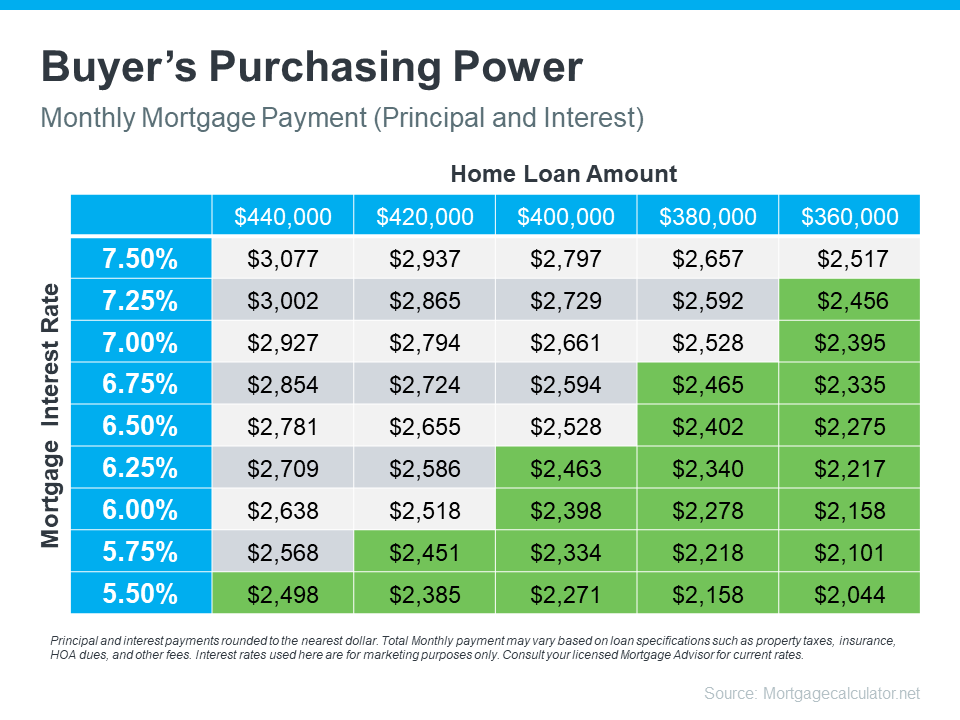

Beyond that, expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

Bottom Line

If you’re worried home prices will come down, don’t be. Many experts believe they’ll actually go up this year. If you have questions or worries about what’s happening with prices in your area, it’s a good idea to talk to a real estate agent.

![Key Terms Every Homebuyer Should Learn [INFOGRAPHIC]](https://housingcoach.com/wp-content/uploads/2024/01/20240119-Key-Terms-Every-Homebuyer-Should-Learn-KCM-Share.png)

![Key Terms Every Homebuyer Should Learn [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240118/20240119-Key-Terms-Every-Homebuyer-Should-Learn-KCM-Share.png)