Why Would I Move with a 3% Mortgage Rate?

If you have a 3% mortgage rate, you’re probably pretty hesitant to let that go. And even if you’ve toyed with the idea of moving, this nagging thought may be holding you back: “why would I give that up?”

But when you ask that question, you may be putting your needs on the back burner without realizing it. Most people don’t move because of their mortgage rate. They move because they want or need to. So, let’s flip the script and ask this instead:

What are the chances you’ll still be in your current house 5 years from now?

Think about your life for a moment. Picture what the next few years will hold. Are you planning on growing your family? Do you have adult children about to move out? Is retirement on the horizon? Are you already bursting at the seams?

If nothing’s going to change, and you love where you are, staying put might make perfect sense. But if there’s even a slight chance a move is coming, even if it’s not immediate, it’s worth thinking about your timeline.

Because even a year or two can make a big difference in what your next home might cost you.

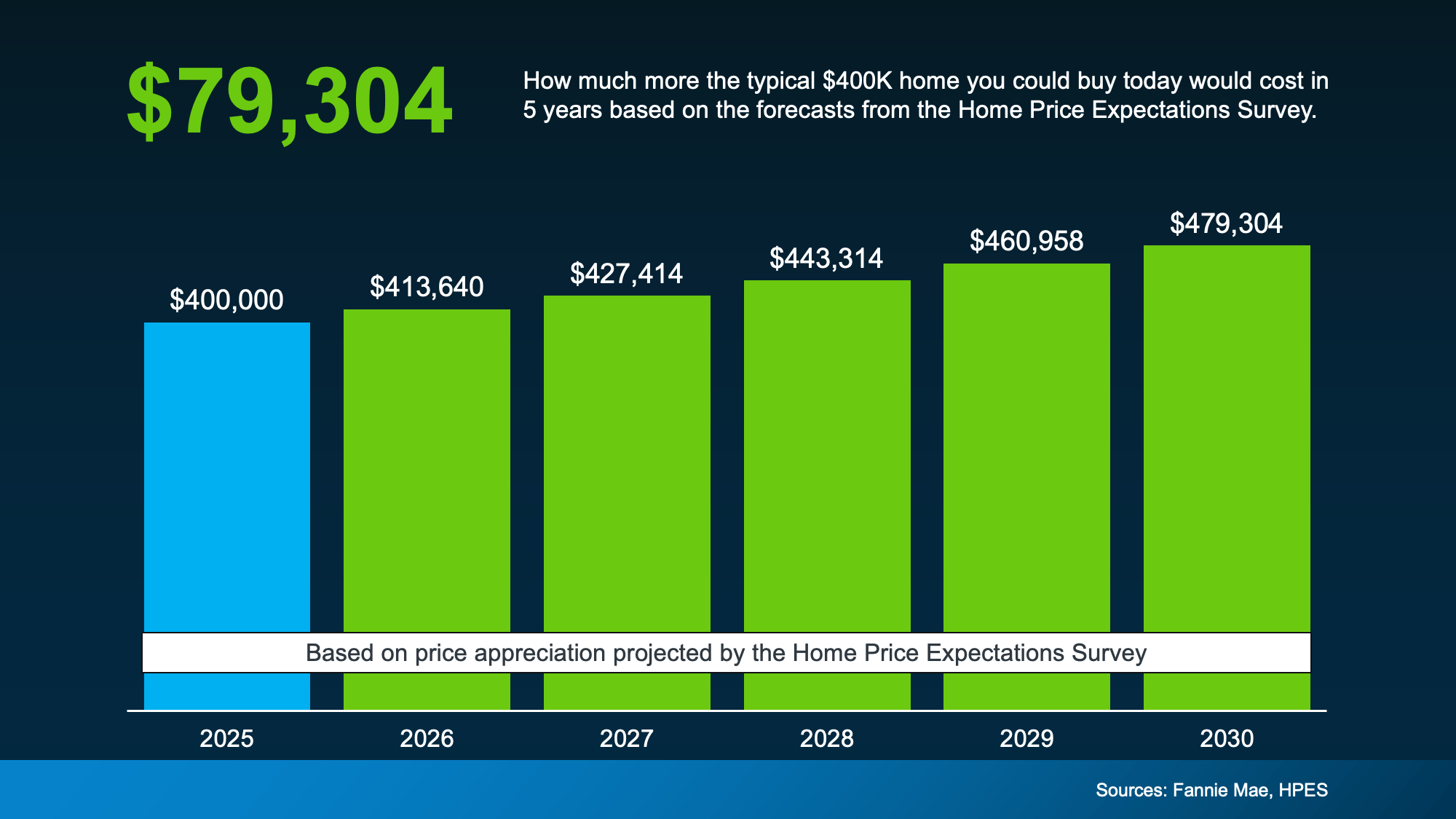

What the Experts Say About Home Prices over the Next 5 Years

Each quarter, Fannie Mae asks more than 100 housing market experts to weigh in on where they project home prices are headed. And the consensus is clear. Home prices are expected to rise through at least 2029 (see graph below):

While those projections aren’t calling for big increases each year, it’s still an increase. And sure, some markets may see flatter prices or slower growth, or even slight dips in the short term. But look further out. In the long run, prices almost always rise. And over the next 5 years, the anticipated increase – however slight – will add up fast.

While those projections aren’t calling for big increases each year, it’s still an increase. And sure, some markets may see flatter prices or slower growth, or even slight dips in the short term. But look further out. In the long run, prices almost always rise. And over the next 5 years, the anticipated increase – however slight – will add up fast.

Here’s an example. Let’s say you’ll be looking to buy a roughly $400,000 house when you move. If you wait and move 5 years from now, based on these expert projections, it could cost nearly $80,000 more than it would now (see graph below):

That means the longer you wait, the more your future home will cost you.

That means the longer you wait, the more your future home will cost you.

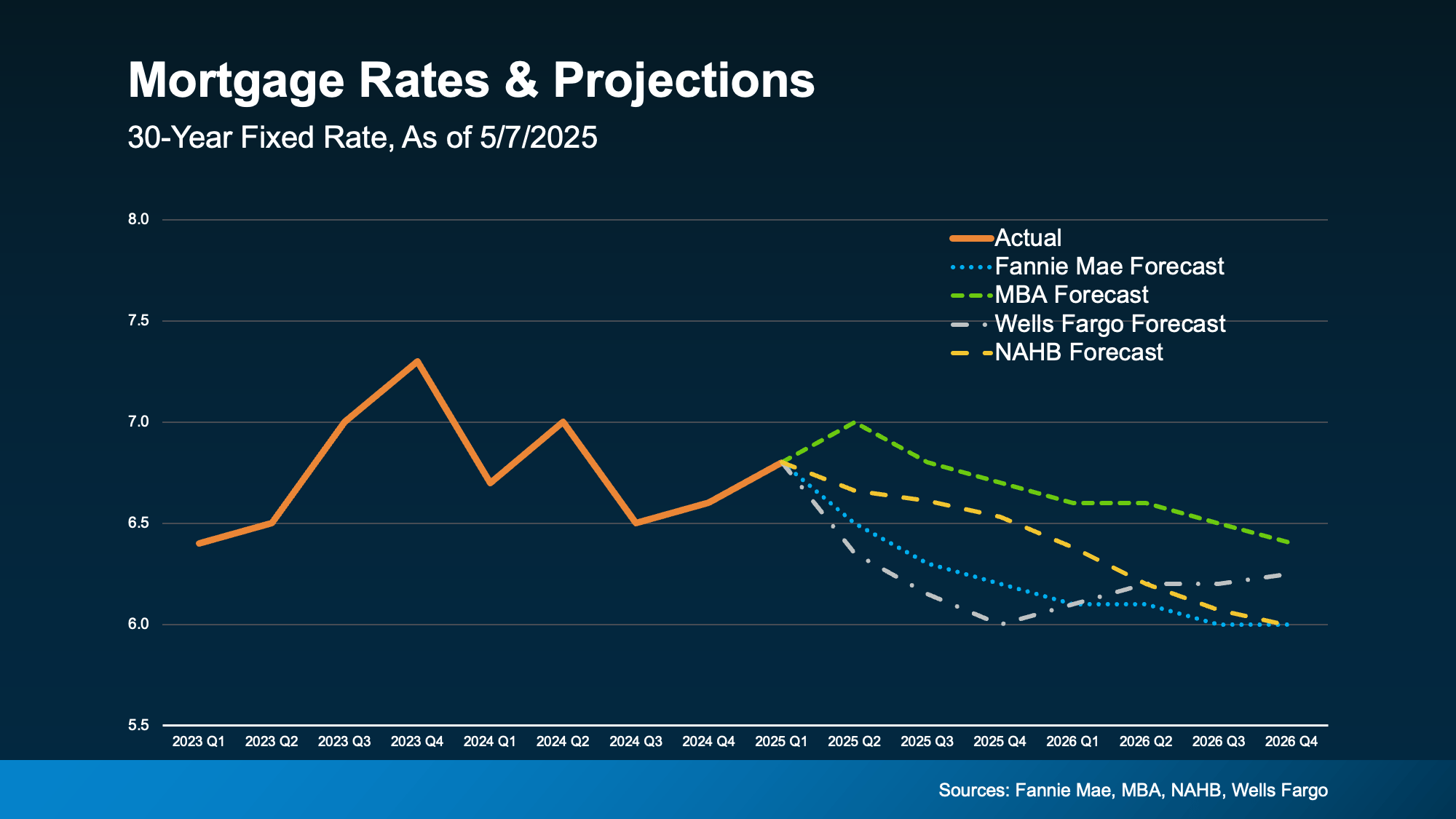

If you know a move is likely in your future, it may make sense to really think about your timeline. You certainly don’t have to move now. But financially, it may still be worth having a conversation about your options before prices inch higher. Because while rates are expected to come down, it’s not by much. And if you’re holding out in hopes we’ll see the return of 3% rates, experts agree it’s just not in the cards (see graph below):

So, the question really isn’t: “why would I move?” It’s: “when should I?” – because when you see the real numbers, waiting may not be the savings strategy you thought it was. And that’s the best conversation you can have with your trusted agent right now.

So, the question really isn’t: “why would I move?” It’s: “when should I?” – because when you see the real numbers, waiting may not be the savings strategy you thought it was. And that’s the best conversation you can have with your trusted agent right now.

Bottom Line

Keeping that low mortgage rate is smart – until it starts holding you back.

If a move is likely on the horizon for you, even if it’s a few years down the line, it’s worth thinking through the numbers now, so you can plan ahead.

What other price point do you want to see these numbers for? Connect with a local agent to have a conversation, so you can see how the math adds up. That way, you can make an informed decision about your timeline.