Trying To Buy a Home? Hang in There.

We’re still in a sellers’ market. And if you’re looking to buy a home, that means you’re likely facing some unique challenges, like difficulty finding a home and volatile mortgage rates. But keep in mind, there are some benefits to being a buyer in today’s market that give you good reason to stick with your search. Here are a few of them.

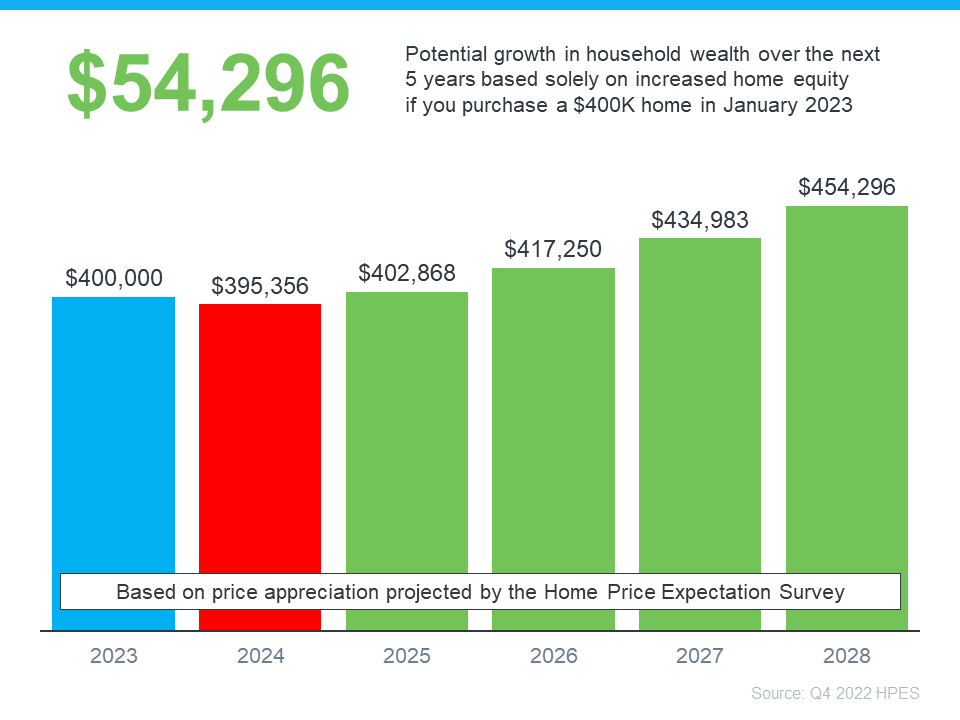

Long-Term Benefits Outweigh Short-Term Challenges

Owning a home grows your net worth – and since building that wealth takes time, it makes sense to start as soon as you can. If you wait to buy and keep renting, you’ll miss out on those monthly housing payments going toward your home equity. Freddie Mac puts it this way:

“Homeownership not only builds a sense of pride and accomplishment, but it’s also an important step toward achieving long-term financial stability.”

The key there is long-term because the financial benefits homeownership provides, like home value appreciation and equity, grow over time. Those benefits are worth the short-term challenges today’s sellers’ market presents.

Mortgage Rates Are Constantly Changing

Mortgage rates have been hovering around 6.5% over the last several months. However, as Sam Khater, Chief Economist at Freddie Mac, notes, they’ve been coming down some recently:

“Economic uncertainty continues to bring mortgage rates down. Over the last several weeks, declining rates have brought borrowers back to the market . . .”

Lower mortgage rates improve your purchasing power when you buy, and that can help make homeownership more affordable. Hannah Jones, Economic Data Analyst at realtor.com, explains:

“As we move into the spring buying season, mortgage rates have ticked lower, a welcomed sign of progress towards affordability.”

The recent drop in mortgage rates is good news if you couldn’t afford to buy a home when they peaked.

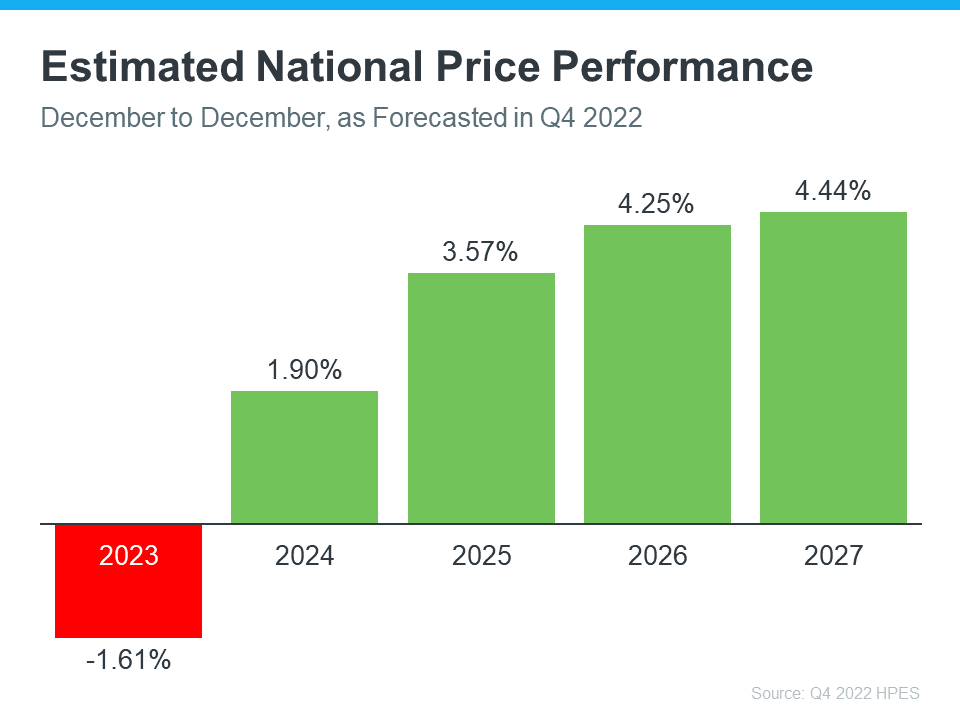

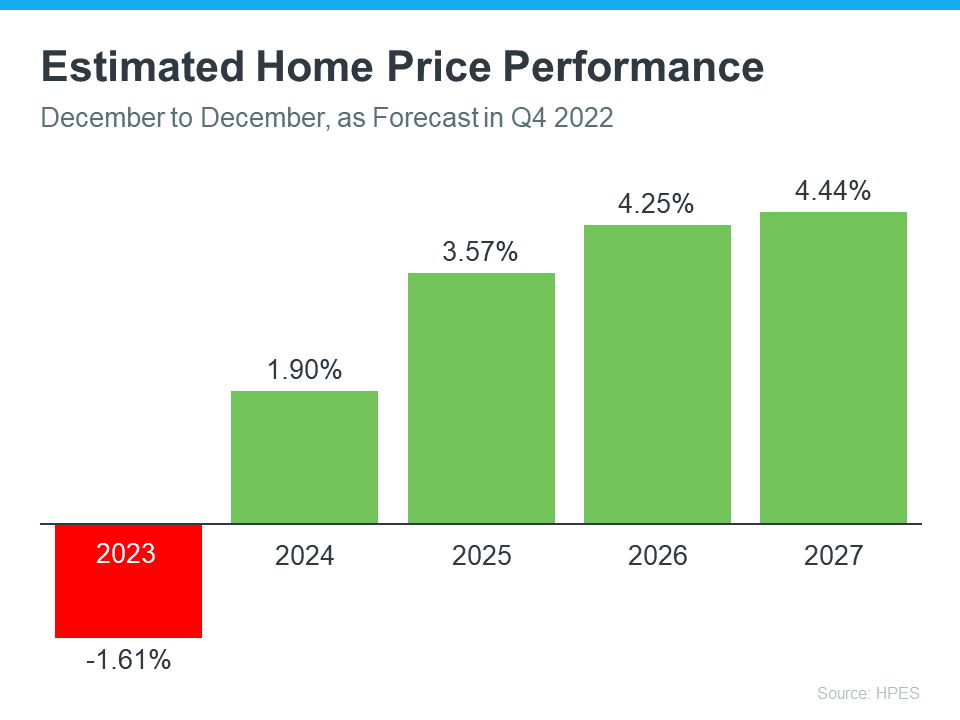

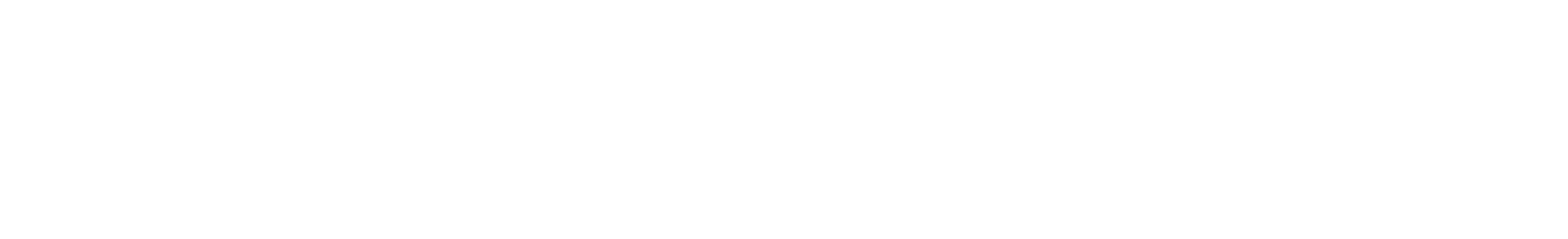

Home Prices Will Increase

According to the Home Price Expectation Survey, which polls over 100 real estate experts, home values will go up steadily over the next few years after a slight decline this year (see graph below):

Rising home prices in the coming years means two things for you as a buyer:

- Waiting to buy a home could mean it’ll become more expensive to do so.

- Buying now means the value of your home, and your net worth, will likely grow over time.

![Facts About Closing Costs [INFOGRAPHIC]](https://housingcoach.com/wp-content/uploads/2023/03/Facts-About-Closing-Costs-KCM-Share.png)

![Facts About Closing Costs [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/content/images/20230330/Facts-About-Closing-Costs-KCM-Share.png)