Planning To Sell in 2026? Start the Prep Now

You’ve got big plans for 2026. But what you do this year could be the difference between a smooth sale and a stressful one. If you’re thinking of selling next spring (the busiest season in real estate), the smartest move you can make is to start prepping now. As Realtor.com says:

“If you’re aiming to sell in 2026, now is the time to start preparing, especially if you want to maximize the spring market’s higher buyer activity.”

Because the reality is, from small repairs to touch-ups and decluttering, the earlier you start, the easier it’ll be when you’re ready to list. And, the better your house will look when it’s time for it to hit the market.

Why Starting Now Matters

Talk to any good agent and they’ll tell you that you can’t afford to skip repairs in today’s market. There are more homes for sale right now than there have been in years. And since buyers have more to choose from, your house is going to need to look its best to stand out and get the attention it deserves.

Now, that doesn’t mean you have to do a full-on renovation. But it does mean you’ll want to tackle some projects before you sell. Your house will sell if it’s prepped right. And you don’t want to be left scrambling in the spring to get the work done.

Because here’s the advantage you have now. If you start this year, you’ll be able to space those upgrades and fixes out however you want to. More time. Less stress. No sense of being rushed or racing the clock.

Whether it’s fixing that leaky faucet, repainting your front door, or finally replacing your roof, you can do it right if you start now. And you have the time to find great contractors without blowing your budget or paying extra for rushed jobs.

Get an Agent’s Advice Early

To figure out what’s worth doing and what’s not in your market, you need to talk to a local agent early. That way you’re not wasting your time or money on something that won’t help your bottom line. As Realtor.com explains:

“Respondents overwhelmingly agree that both buyers and sellers enjoy a smoother, more successful experience when they start early. In fact, a recent survey reveals that, for sellers, bringing a real estate agent into the process sooner can pay off significantly.”

A skilled agent can tell you:

- What buyers in your local area are looking for

- The repairs or updates you need to do before you list

- How to prioritize the projects, if you can’t do them all

- Skilled local contractors who can help you get the work done

And having that information up front is a game changer.

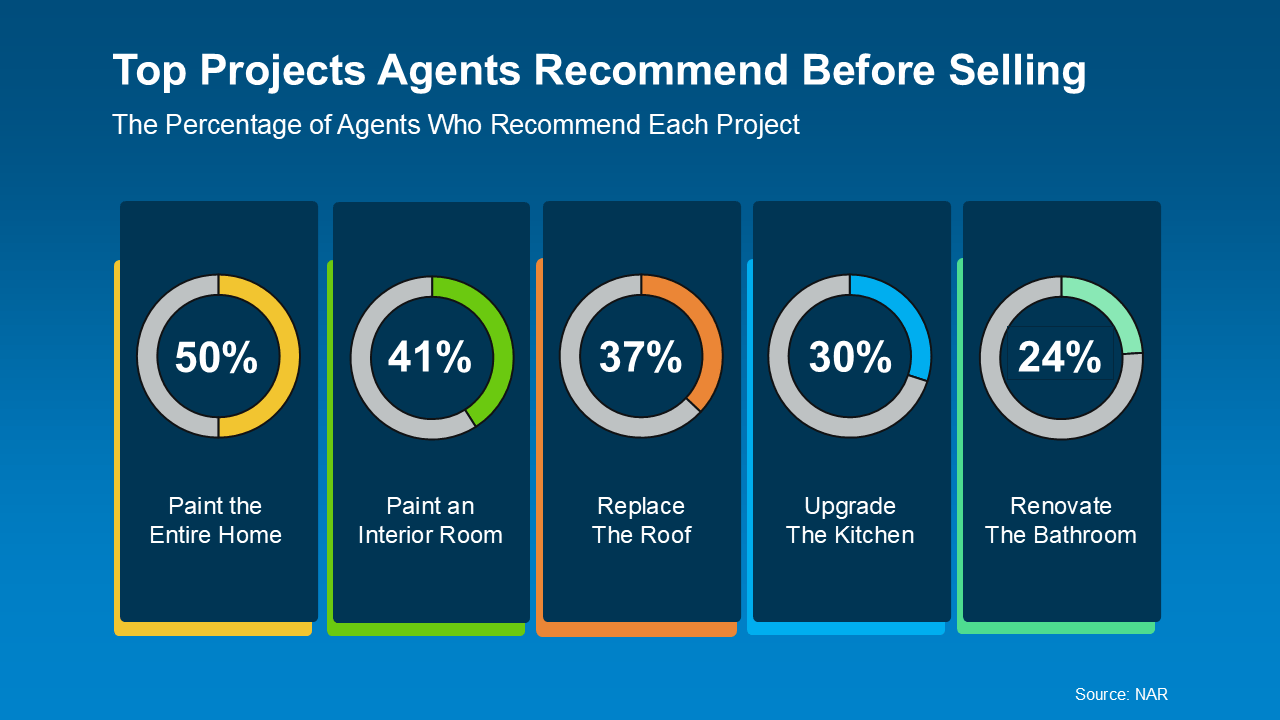

To give you a rough idea of what may come up in that conversation, here are the most common updates agents are recommending today, according to research from the National Association of Realtors (NAR):

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

Your agent will walk you through what you need to do for your specific house and market. And that’s expertise that’ll really pay off.

Bottom Line

If 2026 is your year to sell, the work starts now. Taking some time to prep means you’ll hit the market confident, ready, and ahead of other sellers who waited until January to get started.

Want to know which projects are getting the biggest return on their investment in your market? Connect with a local agent so you can head into next spring with a solid game plan.

BrightMLS

BrightMLS