How Buying a Multi-Generational Home Helps with Affordability Today

In today’s world of rising housing costs, many buyers are looking for ways to still be able to buy a home. Some of them have found a solution in multi-generational living.

Multi-generational living is when two or more adult generations live together under one roof. This includes siblings, parents, or even grandparents. Here’s an in-depth look at why more buyers are choosing this option today, so you can see if it may be right for you too.

Reasons To Buy a Multi-Generational Home

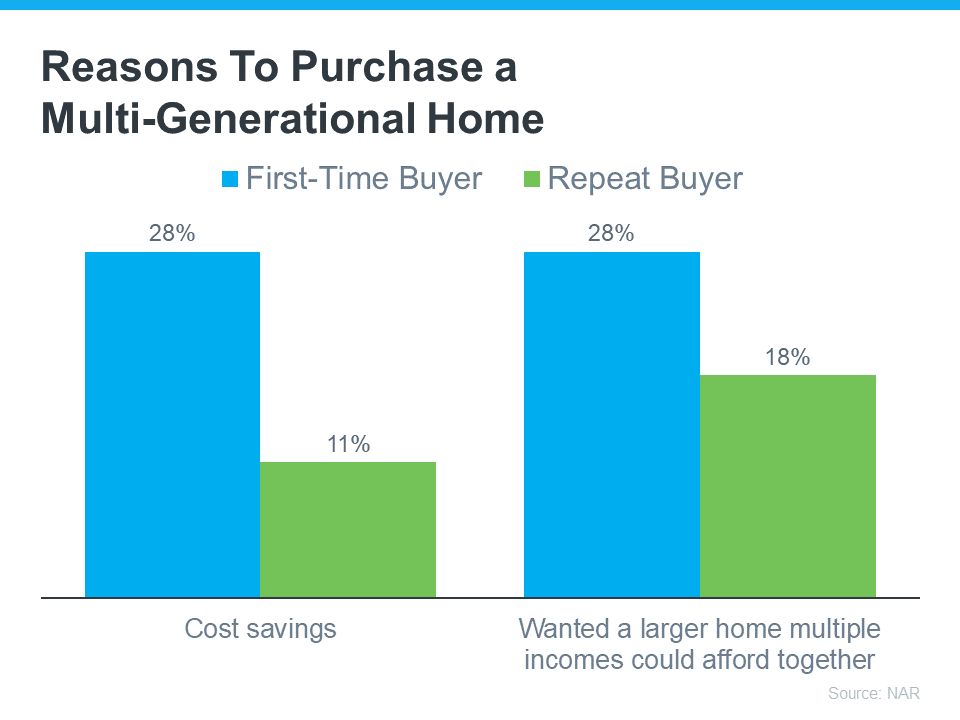

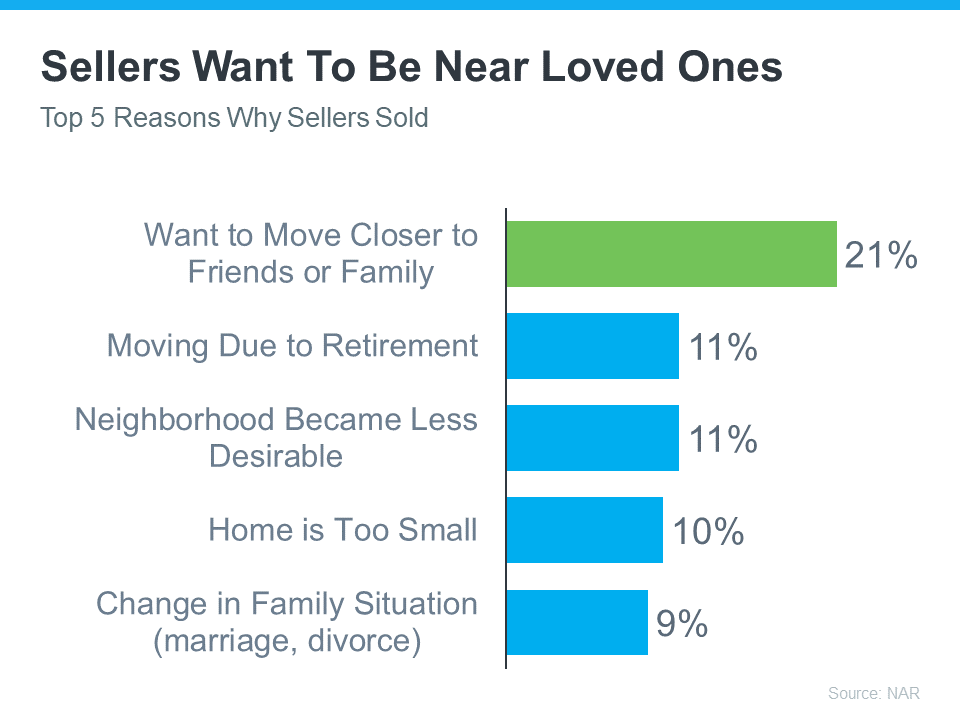

According to a recent study by the National Association of Realtors (NAR), the top two reasons people are opting for multi-generational homes today have to do with affordability (see graph below):

Cost Savings: About 28% of first-time buyers and 11% of repeat buyers are deciding on a multi-generational home to save on costs. By pooling their resources, households can share the financial responsibilities like mortgage payments, utilities, property taxes, and maintenance, to make homeownership more affordable. This is especially helpful for first-time homebuyers who may be finding it tough to afford a home on their own in today’s market.

More Space: Another 28% of first-time buyers and 18% of repeat buyers are doing it because they want a larger home they couldn’t afford on their own. For some of the repeat buyers who listed this as a main motivator, it could be because they find themselves taking care of older parents while also welcoming back young adults who’ve returned to the nest. With everyone chipping in and combining their incomes, suddenly, that big dream home with more space is within reach. As the Triangle Business Journal explains:

“Choosing multi-gen living allows people to purchase a home much larger than they could afford on their own by leveraging the combined income, credit and a down payment of those that they will be occupying the home with.”

Lean on an Expert

If you’re interested in this too, partner with a local real estate agent. Finding the perfect multi-generational home isn’t as simple as shopping for a regular house. That’s because there are more people with even more opinions and needs that should be considered.

You’ve got to make sure everyone has their own space, find room for shared household time, and possibly even create adaptable areas for older relatives. It’s a puzzle, and the pieces need to fit just right. Your real estate agent has the expertise and local knowledge to help you find that home where everyone can be comfortable without breaking the bank. As MoneyGeek.com puts it:

“Having a good multigenerational property can improve the prospects of success when living with loved ones. A multigenerational home should fit the specific needs of most family members regardless of age or health. Speaking to a real-estate agent can help you gain clarity and locate a fit.”

Bottom Line

Buying a multi-generational home can be a smart way to tackle some of today’s affordability challenges. When you team up to share expenses, you can make your dream of homeownership more attainable. If this sounds like an option for you and your loved ones, connect with a local real estate agent to help you find a home that’s the perfect fit.

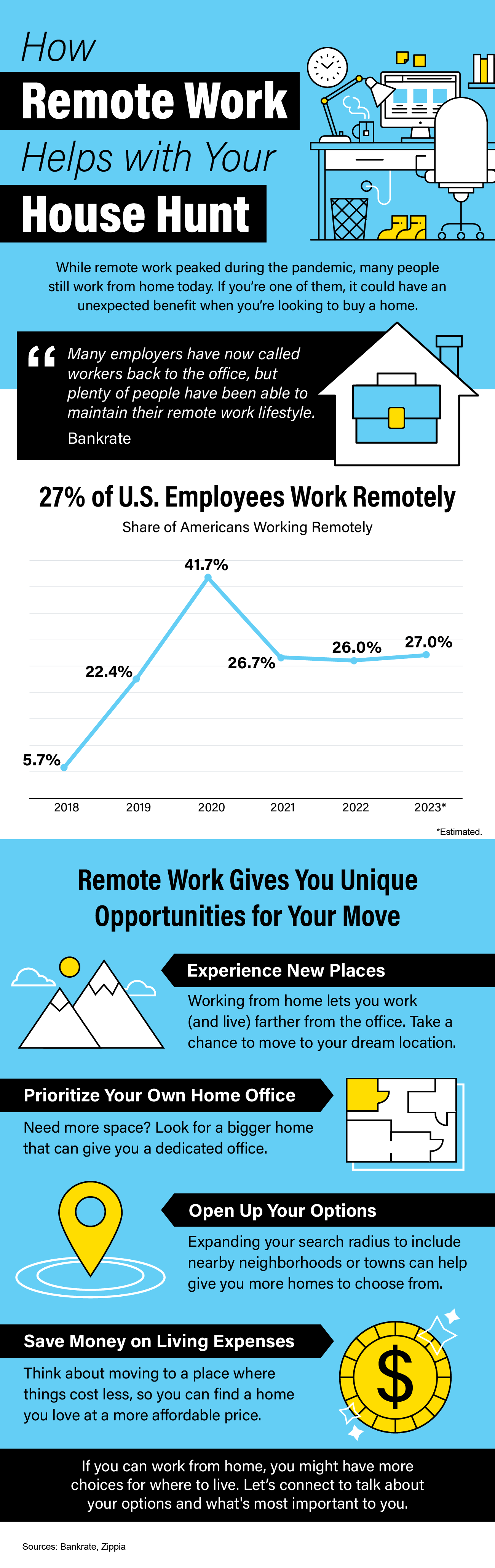

![How Remote Work Helps with Your House Hunt [INFOGRAPHIC]](https://housingcoach.com/wp-content/uploads/2023/09/How-Remote-Work-Helps-with-Your-House-Hunt-KCM-Share.png)

![How Remote Work Helps with Your House Hunt [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/content/images/20230920/How-Remote-Work-Helps-with-Your-House-Hunt-KCM-Share.png)